Remember when “cannabis” meant a simple flower, carefully rolled? That image is fading faster than smoke in the wind. Today, we’re witnessing a revolution not just in legality but in lifestyle. The cannabis sector is undergoing a metamorphosis so rapid that keeping up feels like a full-time job. Are you still thinking of cannabis as just a product, or are you seeing it as the dynamic, multi-billion dollar cannabis industry growth chart it has become?

The pain point is real: how do you, as an enthusiast, entrepreneur, or curious observer, cut through the hype and understand where the real opportunities lie? What does the future of cannabis hold beyond the traditional joint? This article is your definitive guide. We’ll move beyond speculation and ground our analysis in hard data, reliable cannabis consumption statistics, and expert cannabis market projections. We’re here to decode the shift from simple flower to sophisticated beverages, edibles, and beyond, giving you the insights needed to navigate this green wave with confidence. The legal cannabis market isn’t coming; it’s here, and it’s thirsty for innovation.

Understanding the 2026 Cannabis Landscape: By the Numbers

To grasp where we’re going, we must first understand the scale of the present. The cannabis market cap is no longer a niche figure. According to leading financial analysts, the global legal cannabis market is projected to reach staggering new heights by 2026, driven by widening legalization and consumer adoption. But what’s fueling this growth? It’s a fundamental shift in how and why people consume.

Key Cannabis Consumption Statistics Driving Change

Let’s look at the data painting the modern picture:

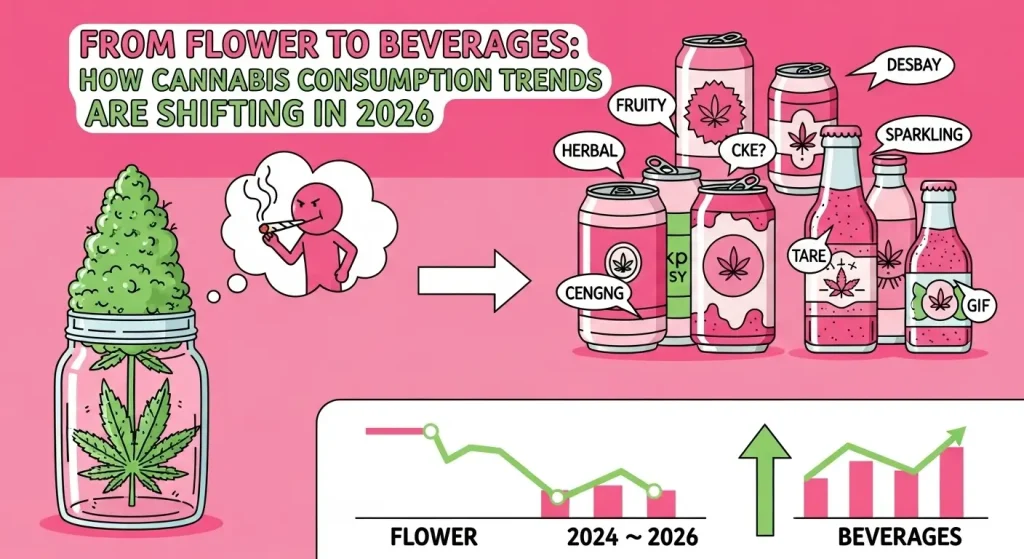

- Diversification of Intake: Smoking, while still popular, is steadily declining as a percentage of total sales in mature markets. A significant portion of new consumers, particularly older demographics and health-conscious individuals, prefer non-inhalable methods.

- The Wellness Pivot: Consumers are increasingly citing wellness reasons—like anxiety relief, sleep aid, and mild pain management—over purely recreational use.

- Social Beverage Revolution: Cannabis-infused beverages are the fastest-growing product category in several U.S. states. They offer controlled dosing, discretion, and a social experience akin to alcohol, without the hangover.

What does your own cannabis inventory look like? Is it still dominated by traditional products, or have you explored these new avenues?

The Engine of Growth: Beyond the Flower

The single biggest driver of the cannabis industry growth chart trending upward is product innovation. The market has moved from commoditizing the plant to branding the experience.

The Rise of Precision and Control

Modern consumers, especially those entering the legal cannabis market, desire predictability. The uncertainty of a traditional edible’s potency and onset time is a major barrier. The industry’s response? Nano-emulsified beverages and fast-acting edibles. These technologies break down cannabinoids into tiny particles, allowing for effects that begin in 15-20 minutes with consistent intensity. This isn’t just an improvement; it’s a prerequisite for mainstream acceptance and reliable cannabis market projections.

Beverages: The Frontline of the Consumption Shift

Why are beverages winning? They solve multiple consumer pain points:

- Familiarity: The ritual of opening a can or bottle is deeply ingrained in social settings.

- Dosage Control: Each can is a precisely measured serving, eliminating guesswork.

- Discretion & Health: No smoke, no odor, and often lower calories than alcoholic alternatives.

- Flavor Exploration: From craft-style hop-infused drinks to fruity mocktails, the flavor profiles are sophisticated and appealing.

This category isn’t just growing; it’s reshaping the entire cannabis sector‘s approach to product development. Major beverage alcohol companies are taking note, investing heavily, and forming partnerships, signaling a long-term belief in this convergence.

Navigating the Future: Opportunities and Strategic Imperatives

So, what does the future of cannabis hold for businesses and investors? The growth is undeniable, but success requires a sophisticated strategy beyond just having a product on the shelf.

Building a Resilient Cannabis Inventory Strategy

In a market shifting from bulk flower to diverse, branded SKUs, inventory management is a make-or-break function. A modern cannabis inventory system must account for:

- Short Shelf-Life Products: Beverages and fresh edibles have expiration dates, demanding just-in-time logistics and sharp sales forecasting.

- Compliance & Traceability: Every product must be tracked from seed to sale, requiring robust, integrated software.

- Demand Forecasting: Using cannabis consumption statistics and local sales data to predict which products will move, preventing costly overstock or missed opportunities.

Ask yourself: Is your supply chain agile enough to handle this new product mix, or are you at risk of being left with obsolete stock?

The Investment Landscape: Reading the Cannabis Market Cap

The total cannabis market cap reflects aggregate investor confidence. While valuations have seen volatility, the underlying growth narrative in the legal cannabis market remains strong. Savvy investors are now looking at:

- Technology & Ancillary Services: Companies providing cultivation tech, point-of-sale software, and compliance solutions often present less regulatory risk than plant-touching businesses.

- Brands with Loyal Followings: In a crowded market, consumer-packaged goods (CPG) principles rule. Strong branding and customer loyalty are key indicators of longevity.

- International Expansion: As more countries legalize medically or recreationally, first-mover advantages in new regions are creating significant value.

The Regulatory Hurdle: Growth’s Constant Companion

It’s impossible to discuss accurate cannabis market projections without addressing the elephant in the room: a fractured regulatory landscape. Federal illegality in the United States continues to create massive inefficiencies, from lack of banking access to restrictive interstate commerce. However, the trend is unmistakably toward normalization. Rescheduling efforts, state-level legalization, and growing public approval are slowly eroding these barriers. The cannabis sector that will thrive is the one that plans for both the current reality and the inevitable, more open future of cannabis.

Conclusion: Your Role in the Green Transition

The journey from flower to beverages is a powerful metaphor for the entire industry’s maturation. It’s a shift from a raw agricultural commodity to a refined, consumer-centric experience. The cannabis industry growth chart is being redrawn by innovation, data, and a deep understanding of modern consumption habits.

Staying informed with the latest cannabis consumption statistics and cannabis market projections is no longer optional—it’s essential for anyone involved in this space. Whether you’re a consumer exploring new options, a business owner optimizing your cannabis inventory, or an investor analyzing the cannabis market cap, the message is clear: adaptability is key.

Ready to dive deeper? Share this article with your network to spark a conversation, or explore our other guides on [specific cultivation techniques] and [understanding cannabinoids] to build your expertise. The future is green, diverse, and full of potential—what will your next move be?

Frequently Asked Questions (FAQs)

Q1: What is the projected size of the legal cannabis market by 2026?

A1: While estimates vary between analysts, major financial institutions project the global legal cannabis market to reach between $50 and $70 billion USD by 2026, driven by continued legalization and product diversification like beverages and edibles.

Q2: Are cannabis beverages really that popular?

A2: Yes. In mature markets like California and Colorado, cannabis-infused beverages are consistently among the fastest-growing product categories. They appeal to both new consumers seeking a familiar, discreet experience and traditional users looking for an alternative to smoking.

Q3: What does “cannabis market cap” refer to?

A3: The cannabis market cap (market capitalization) typically refers to the total combined value of all publicly traded companies within the cannabis sector. It’s a key metric investors use to gauge the overall size and investor sentiment toward the industry.

Q4: How important is inventory management in the cannabis industry today?

A4: Extremely important. With the rise of perishable, branded goods like beverages, effective cannabis inventory management is critical for profitability. It prevents loss from expired products, ensures compliance, and helps meet fast-changing consumer demand.

Q5: What is the biggest challenge facing the cannabis industry’s growth?

A5: The most significant challenge remains the complex and inconsistent regulatory environment, particularly in the U.S. where federal prohibition creates obstacles for banking, taxation, and interstate commerce, hindering the full potential of the cannabis industry growth chart.

Q6: What are “cannabis market projections” based on?

A6: Reputable cannabis market projections are based on a mix of current sales data (cannabis consumption statistics), regulatory trends, demographic studies, consumer surveys, and economic modeling to forecast future market size, growth rates, and product segment performance.